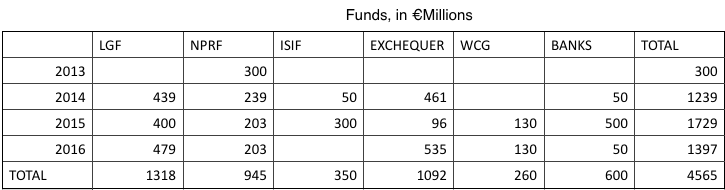

It has become more and more difficult to understand where Irish Water funds come from, and the government has certainly not helped, merging funds into one another, diverting investments…

€6.5bn earmarked so far, and counting

LGF - Local Government Fund

NPRF - National Pension Reserve Fund

ISIF - Irish Strategic Investment Fund

WCG - Water Conservation Grant

1-Local Government Fund (LGF )

The LGF was set up to fund local authorities. You pay your motor tax, it gets pooled into a central fund and is then redistributed for what it is intended to address, eg roads. But the government doesn’t see it like that.

The LGF fund receives €1bn per year from motor tax, and since 2014 it also receives the newly introduced Local Property Tax (LPT), to the tune of €500m per year. Also supposed to be redistributed to Local Authorities.

€1.3bn of LGF funds will go to Irish Water by 2016:

(source)

2-National Pension Reserve Fund (NPRF)

Irish Water had accrued €14m debt already late last year on its borrowings from the National Pension Reserve Fund.

The debt was confirmed by Finance Minister Michael Noonan after a Dáil parliamentary question revealed the original €250m loan had risen to €300m.

Responding to questions from the Fianna Fáil environment spokesman Barry Cowen, Mr Noonan said the money was provided to help Irish Water pay for meters being installed from 2015 to 2019.

He said the deal was made in July 2013, when a €250m “bridging loan facility” was handed over by the reserve fund.

The money, which rose to €300m after a further request this month, was paid over in two parts, at the end of last year and during summer 2014.

It is due to be fully repaid by next September.

If it is due to be paid back by September, I wonder why the same fund is being plundered again in 2015/2016:

€945m of NPRF funds will go to Irish Water by 2016:

(source)

3-Irish Strategic Investment Fund (ISIF )

Interestingly, the ISIF will be merged with the NPRF and replace it.

As much as LPT was being merged with the LGF, once again funds are shuffled and tricks are pulled, making it difficult to understand if the numbers cited in different newspapers took this into account or not.

Regardless, and until this has been cleared, the numbers cited in those articles do not tally up, so I’ve kept them separate:

€300m of ISIF funds will go to Irish Water by 2016 (source)

4-Exchequer

Once again, this could be another trick by the government. It is easy to say that ISIF and LGF funds are part of the Exchequer remit, but once again figures provided in the media made no distinction whatsoever and did not add up when compared to other funds.

5-Water Conservation Grant (WCG)

This program is set to cost €130m a year, but there is no indication that this will be drawn from existing funds featured in the table.

€260m need to be spent to finance WCG until 2016

(source)

6-Banks

Despite all this generosity and ingenuity from the government to make it as murky as possible, Irish Water also asked the banks for help.

€600m of private funds will go to Irish Water by 2016.

(source)

7-Is there more?

Of course there is.

Irish Water now also collect Commercial Rates from Local Authorities, that’s another €250m a year.

€750m of Commercial Rates will go to Irish Water by 2016.

The table at the top of this article is only for period 2013–2016, but tens of millions had already been spent in 2012:

-Hogan knew of €40m Irish Water consultancy allocation in 2012

- “speaking to reporters on 15 January, Hogan said he wasn’t aware of the specifics of the spend on external services, noting that he “certainly knew” about the total €180 million cost of setting up the company” (link)

€200m were spent in 2012 setting it up.

NB: it is unclear if these costs were part of the NPRF €300m loan in 2013 featured in the table above. According to this article from 2012:

€450 million would be given to Irish Water from the National Pension Reserve Fund, which would be passed on to customers through a standing charge over 20 years.

And the financing involves hundreds of other millions:

-Irish Water will also be spared €60m in rates charges that other utilities will have to pay

-On top of this up to €40m extra will have to be paid out to homes that are not customers of Irish Water

-Siteserv, the business purchased by Denis O’Brien from IBRC, with a write off of €110 million, was subsequently awarded the water meter contract.

-Energy watchdog to pay consultants €900k for advice on Irish Water

-State underwrites new €100m borrowing by Irish Water

Total: €1.2bn extra funds in exemptions and for CER

And in another bewildering statement, the IMF has now hinted that failing the Euro test would not put the utility in jeopardy, instead they would throw another €550m at it! And to fail it is.

Do the Maths

By 2016:

1-€1.3bn of LGF funds

2-€945m of NPRF funds

3-€300m of ISIF funds

4-€1.1bn of Exchequer funds

5-€260m need to be spent to finance WCG

6-€600m of private funds

7-€750m of Commercial Rates

8-€1.2bn extra funds in exemptions and for CER

TOTAL: €6.5 Billion

And that’s before the €550m the IMF suggested we throw at it again if it fails the EU test.